Turkish online shoppers and retailers face isolation from the international community following an announcement that the operations of PayPal, the global e-commerce payments provider, will cease operations in Turkey on 6 June 2016.

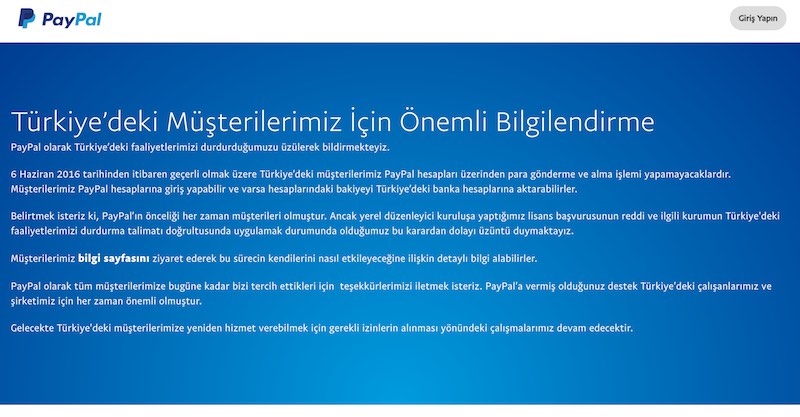

PayPal has stated that it will no longer offer transactions via Turkey bank accounts after BDDK, the Turkish banking regulator, repeatedly refused to grant the necessary operation license to the US-based business. Online and hi-tech business has been struggling amidst a backdrop of political uncertainty, ongoing fighting and challenges to the country’s constitution.

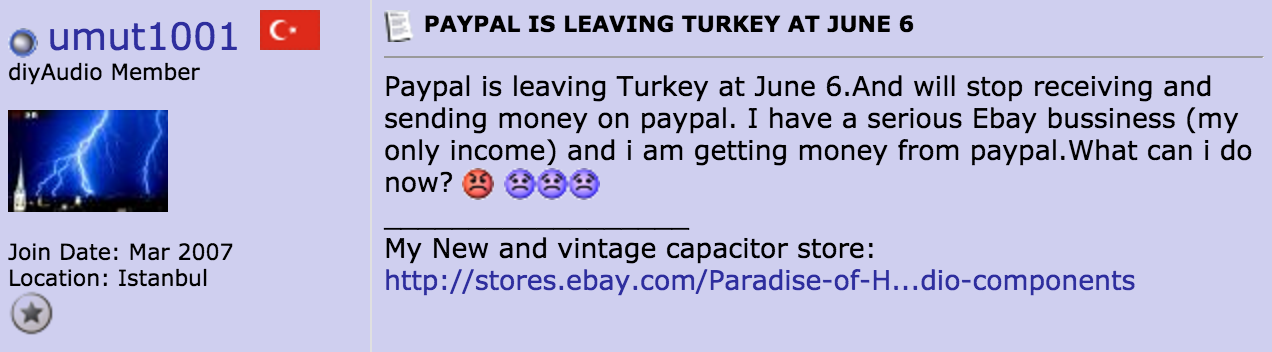

Within hours of the announcements, traders based in Turkey who use PayPal to sell to international markets were left explaining to their customers that they will no longer be able to do business:

IMPORTANT: Paypal is withdrawing from Turkey. For that reason, I will no longer be able to sell at Bandcamp…. https://t.co/kqiPjUE1U0

— Oganalp Canatan (@oganalp) May 30, 2016

Although not widely used in domestic online sales in Turkey, where payment-upon-delivery is still commonplace, PayPal has become a key trading tool for boutique vendors, particularly sellers of homemade goods, arts and crafts targeting buyers in western Europe and the United States.

Turkish consumers who subscribe to paid news sites, cloud services and music streaming apps like Spotify, or who buy goods from international e-commerce sites like eBay will also struggle to find alternatives given PayPal’s dominance in the micropayment sector.

Analysts have classed the BDDK as a politically motivated element of a wider isolationist strategy, as one of the unsatisfied requirements demands that server data be stored locally in Turkey potentially making confidential records available to the ruling party and presidency. Meanwhile, international corporations have come under fire for their use of offshore accounting and complex business structures designed to evade local tax commitments, a factor which is likely to dampen outrage at the regulator’s decision.

Turkey has a small but growing ecosystem of online payment services that compete with PayPal. It is unclear if the withdrawal will materially benefit similar Turkish startups, given the fear and uncertainty caused by the far-reaching decision in an economy much in need of stability after a sustained and ongoing period of decline.