Just two years ago, Turkey’s startup scene could turn a few heads. Vibrant, cosmopolitan and unafraid to challenge the status quo, young graduates and enterprising students schemed big plans. Convening in bristling historic coffee shops, Turkey’s startup generation had developed its own unique entrepreneurial character — trailblazers in a country well on its way to gaining international recognition.

Fast-forward to 2016, and the landscape could not seem more desolate — everything has changed, both figuratively and practically. Where international symposia on digital currencies and seminars on big data were once held, conference halls now lie mothballed, tanks line the streets and military command posts dot the landscape. Despite government efforts to suppress wartime imagery in the media, the country’s internal strife is now something of an open secret and innovation has reluctantly taken the back seat.

New Exit Strategies

For startups which have weathered the economic storm, the modus operandi has altogether changed — it is no longer a question of building a successful product with a steady customer base, but rather a rush to wine and dine risk-taking investors who might be able to secure immigration visas to countries like the United Kingdom, United States or Germany.

Turkey’s government has recently tightened the country’s 26-year liberal foreign exchange rules. Travellers exiting Turkey are now required to make declarations of cash and credit cards or face sanctions on charges of money laundering and smuggling. Similar checks on business transactions are now accelerating the flight of foreign investors – even if an investment pays off, there is simply no way financiers can achieve returns.

As Turkish ambitions give way to more practical concerns for financial stability and personal safety, so has the meaning of the fabled “exit” taken on a far more literal meaning — no longer a milepost to cash in on shares, but rather a byword for escaping the country’s borders and attaining citizenship elsewhere.

“Uninvestable”

“How can I focus on growth hacking when our offices are getting shelled and we have no power?” asks one business founder we spoke with who wished to remain anonymous.

For those in Turkey’s eastern provinces, security concerns have come to a fever pitch. As casualties are reported daily, deaths caused predominantly by government-backed militia forces but also at the hand of local community defence groups, a deep mistrust of the state has festered into open rebellion.

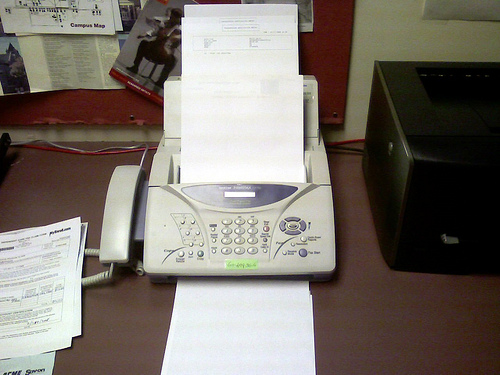

“Five years ago, we were conducting most business online and by email. Last year we had to install a fax machine, something we never used before ”

In these regions, office health and safety procedures have yielded way to more existential threats, suit and tie now supplanted by military fatigue.

Antiquated Business Practices

The rapid militarisation of Turkish society is not the only challenge for Turkey’s remaining entrepreneurs: red tape weighs heavy on young businesses that need to remain agile to stand a chance against better-funded foreign competitors. In a country where business contracts still need to be signed by hand, documents sent by courier and legal papers notarised and physically stamped in triplicate at notary houses located in each city, investors are quick to ask how any Turkish business might ever attain relevance and achieve monetisation on the international stage.

“Turkey is going back in time not just politically but technologically”

Technology problems reach far beyond the startup world; even in the administrative heart of Turkey, capital city Ankara, the country’s legal system is something of a relic. Turkey’s IT portal for lawyers is built on something called Java — not a brand of coffee for hipsters, but an antiquated software platform once popular in the 90s that won’t even run on new computers, let alone the latest tablets or mobile devices that are the mainstay of government IT procurement in developed countries.

Lawyers who use the system have to use outdated and easily hacked versions of computer programs just to participate online. There could not be a more stark contrast to law technology hubs like Boston and London that have been iteratively streamlining legal process with cutting edge information management systems and public-private sector collaborations on open data in recent years.

Some growth markets remain

The outlook in Turkey’s emerging technology market is not entirely bleak. There are a handful of startling growth markets: independent media news portals have seen multiple rounds of investment in 2015 thanks to the elimination of their natural competition — mainstream press outlets such as newspapers and TV channels were systematically shut down or downsized by government order. Digital security start-ups selling products like VPN software allowing Turkish citizens to access the Internet have also seen continued growth from 2013 through 2015.

Yet these industries are the products of a vacuum left by government policy intended to reign in free media and limit citizens’ access to certain categories of online content — almost every other technology sector is now in decline.

Power, but at what cost?

In a rush to gain power and dismantle Turkey’s secular state, it has been argued that the ruling AK Party effectively created deep-running fissures in the country’s power balance that divided the country, pushing it beyond the brink of civil war. The narrative goes that, should the AKP terminate democratic reconciliation at this point, military efforts to halt a seemingly unstoppable movement for self-rule in Kurdish regions may trigger a wider conflict that could dismantle years of progress and democratisation.

Government failure to recognise different ethnicities and faiths and rapidly make amends may thus threaten to eviscerate business potential and investment prospects in Turkey through the coming decade and beyond. As financial reserves begin to dip perilously low, the leadership may soon be left wondering where all the businesses went — meanwhile, investors caveat emptor.

Photo by Ervins Strauhmanis